42 private label credit card issuers

Nov 25, 2012 · CrowdStrike (CRWD) tumbles following Q3 earnings release. CrowdStrike Holdings Inc. (NASDAQ: CRWD) shares plunged in after-hours trading following its fiscal third-quarter 2023 earnings report ... What Is a Private Label Credit Card? | GoCardless The third-party partner (or private label credit card provider) assists in several areas, including issuing, funding, and payment collection. Because private credit cards are managed by banks or financial institutions, they offer exactly the same level of security and transparency as standard-issue credit or debit cards.

Private Label Credit Cards in the U.S., 2019-2021 - Business Wire Private Label Credit Card Bank Issuers Alliance Data Systems Capital One Citi Retail Services Synchrony Financial TD Bank Wells Fargo 2. Market Size and Forecast Six Issuers Dominate...

:max_bytes(150000):strip_icc()/GettyImages-966220948-cb336a710187449bb0432b6c2125f561.jpg)

Private label credit card issuers

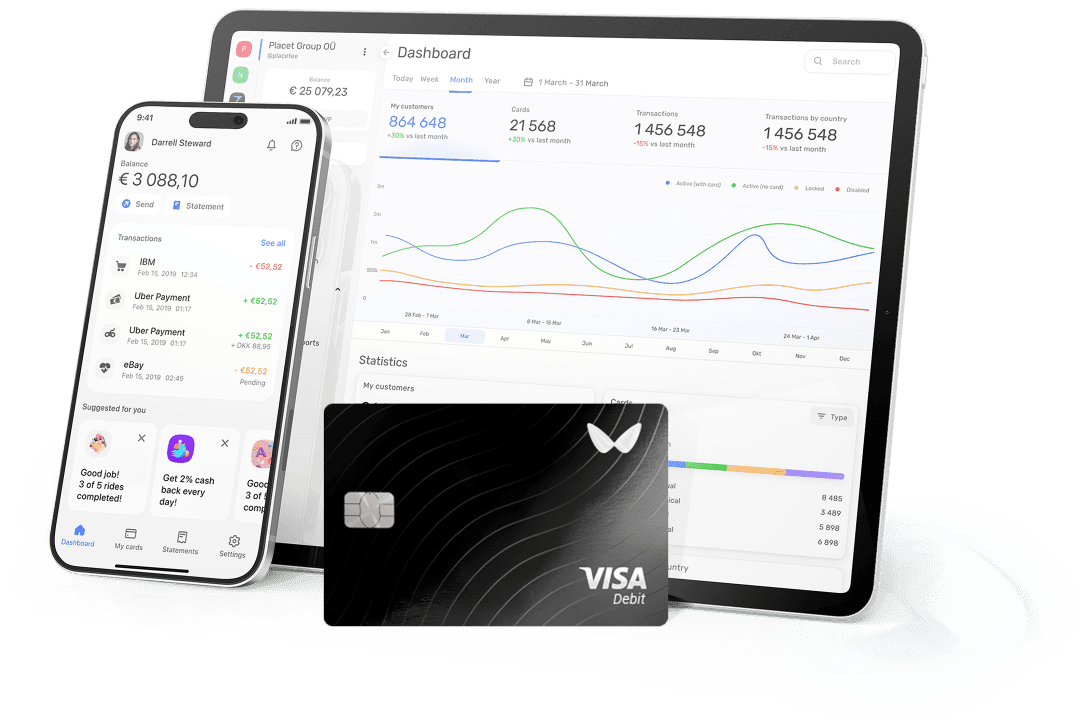

Guide to Private Label Credit Cards | SoFi A private label credit card is a type of card only usable at a specific store. Learn about the benefits and drawbacks, and how to get a private label credit card. Heads Up: The Fed continues to raise rates — up 3% this year — making credit card debt even costlier. Private Label vs Co-Branded Credit Cards: What's the Difference? Most private-label credit cards use a third-party financial institution to help with payment collection and issuing. These credit cards may have a store name on them, but a reliable and secure banking institution still operates them. This helps reduce any hidden fees or shady practices by the company offering the credit card. Credit Card Issuer Market Share: Top 25 Issuers of 2022 - CardRates.com The top-10 card issuers include all of the biggest brand names in the business. Chase, Citi, Bank of America, Capital One, Wells Fargo, and U.S. Bank, which issue Visa and Mastercard cards, are in the top eight along with American Express and Discover, which issue their own cards. Barclays and Synchrony Financial rounded out the top 10.

Private label credit card issuers. Synchrony Financial Integrates Private Label Credit Cards and Patented ... as the largest provider of private label credit cards in the u.s. 1, synchrony financial is committed to supporting the benefits our private label credit cards and patented dual cards offer - including loyalty and rewards programs, point of sale discounts and promotional financing - when customers choose to make easy and secure payments with … US Private Label Credit Cards Report 2021 Featuring Alliance Data ... Outlines the going-forward strategies of top private-label credit card issuers. Those issuers are Alliance Data Systems, Citi Retail Services, Capital One, Synchrony Financial Services, TD Bank ... 5 Things to Know About the Private Label Credit Card Industry Competitive landscape: The private label retail credit card market is dominated by six bank issuers — which are each profiled in detail in the Packaged Facts report — including Alliance Data Systems, Capital One, Citi Retail Services, Synchrony Financial, TD Bank, and Wells Fargo. Credit Card Issuer Market Share: Top 25 Issuers of 2022 - CardRates.com The top-10 card issuers include all of the biggest brand names in the business. Chase, Citi, Bank of America, Capital One, Wells Fargo, and U.S. Bank, which issue Visa and Mastercard cards, are in the top eight along with American Express and Discover, which issue their own cards. Barclays and Synchrony Financial rounded out the top 10.

Private Label vs Co-Branded Credit Cards: What's the Difference? Most private-label credit cards use a third-party financial institution to help with payment collection and issuing. These credit cards may have a store name on them, but a reliable and secure banking institution still operates them. This helps reduce any hidden fees or shady practices by the company offering the credit card. Guide to Private Label Credit Cards | SoFi A private label credit card is a type of card only usable at a specific store. Learn about the benefits and drawbacks, and how to get a private label credit card. Heads Up: The Fed continues to raise rates — up 3% this year — making credit card debt even costlier.

![U.S. Credit Card Market Share - Facts & Statistics [2022]](https://upgradedpoints.com/wp-content/uploads/2022/01/Credit-Card-Issuers-by-Purchase-Volume.png)

![U.S. Credit Card Market Share - Facts & Statistics [2022]](https://upgradedpoints.com/wp-content/uploads/2022/01/2020-Credit-Card-Networks-by-Purchase-Volume.png)

:max_bytes(150000):strip_icc()/parts-of-a-debit-or-credit-card-front-and-back-315489-42e20e660e15471cac4b955a77e2e331.jpg)

Post a Comment for "42 private label credit card issuers"